Embarking on your entrepreneurial journey? Ensuring the well-being of your employees is paramount. Understanding and complying with legal requirements like Employees' State Insurance Corporation (ESIC) registration is crucial. This resource provides a concise overview of ESIC registration, outlining the steps, benefits, and necessities.

Let's delve into the basics of ESIC registration to empower you with the knowledge necessary to efficiently navigate this process. Whether you are a new employer or seeking to update your understanding, this guide has something valuable to offer.

- Enrolling for ESIC is a simple process that can be completed online or offline.

- ESIC registration offers extensive benefits to both employers and employees, encompassing medical coverage, maternity benefits, and disability insurance.

- Understanding the eligibility criteria is essential before initiating the registration process.

By adhering to the documents for esi registration guidelines outlined in this guide, you can confirm a smooth and effective ESIC registration experience.

Submitting Your ESI Records

Successfully completing the ESI registration process can feel like a daunting task. Despite this, with careful consideration and a clear understanding of the guidelines, you can simplify the process. Initially, it's essential to collect all necessary materials. This typically includes your entity's legal name, contact information, and a thorough description of the ESI you intend to submit.

- Following this, carefully examine the specific requirements governing ESI registration in your area.

- Furthermore, you may need to fill out certain applications.

- Finally, verify that you upload your application accurately and within the designated deadline.

Submit for PF and ESIC Benefits: Step-by-Step Instructions

Securing your retirement funds is crucial. The Provident Fund (PF) and Employees' State Insurance Corporation (ESIC) offer valuable schemes to safeguard your well-being. Let's to register for these essential schemes step-by-step.

- , collect the necessary papers. This typically includes your identity proof, utility bill, pay statement, and your employer's information.

- visit the platform of your respective department. You can discover these websites through a simple web inquiry.

- After that thoroughly submit the online application form. Ensure that all the details you provide is precise.

- Following submission a confirmation message/email will be sent to your specified electronic mail account. The confirmation serves as proof of your registration.

- , preserve all necessary papers for future verification.

Understanding PF and ESIC Charges & Fees

Navigating the realm of workforce benefits can sometimes feel like deciphering a complex code. Two frequently encountered terms in this field are PF (Provident Fund) and ESIC (Employees' State Insurance Corporation). These schemes are designed to offer financial protection to workers, but understanding the intricacies of their fees can be a bit confusing.

PF, often referred to as retirement savings, is essential for most organizations in India. It involves monthly contributions from both the firm and the worker, allocated into individual accounts. ESIC, on the other hand, focuses on providing healthcare benefits to registered employees and their dependents. This scheme is funded through contributions from both the employer and employee, ensuring access to care in case of illness or trauma.

- Understanding these charges is crucial for both employers and employees.

- It helps in controlling finances effectively.

- Furthermore, awareness about PF and ESIC benefits can empower individuals to make informed decisions regarding their well-being.

Simplify ESIC Registration for Employers

Navigating the complexities of Employee's State Insurance Corporation (ESIC) registration can pose a challenge for employers. However, recent developments have rolled out simplified procedures to ease this burden. Employers now benefit from a more streamlined registration process that is convenient. This includes an web-based platform for submission applications and simplified documentation {requirements|.

By embracing these improvements, employers can quickly register their workforce with ESIC, ensuring compliance with labor laws and benefiting from the valuable social security benefits provided by the scheme.

Understanding PF and ESIC Registration: What You Need to Know

Starting an individual business in India requires you to fulfill several legal obligations. Two of the most crucial ones are PF and ESIC registration. PF stands for Provident Fund, which is a retirement savings scheme, while ESIC refers to the Employees' State Insurance Corporation, which provides health insurance coverage to employees.

The process of registering for both PF and ESIC involves certain actions. First, you need to collect all the necessary files, such as your PAN card, Aadhaar card, and business registration records. Then, you will have to lodge an application online to the respective authorities.

Following successful registration, you will be allotted a unique PF and ESIC account number. It is essential to update these accounts regularly by depositing the required contributions on time.

- Failure to comply with PF and ESIC regulations can result in heavy penalties.

- Hence, it is prudently suggested to register for both schemes as soon as possible to stay clear of any legal problems.

Mr. T Then & Now!

Mr. T Then & Now! Seth Green Then & Now!

Seth Green Then & Now! Michelle Trachtenberg Then & Now!

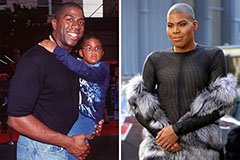

Michelle Trachtenberg Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now!